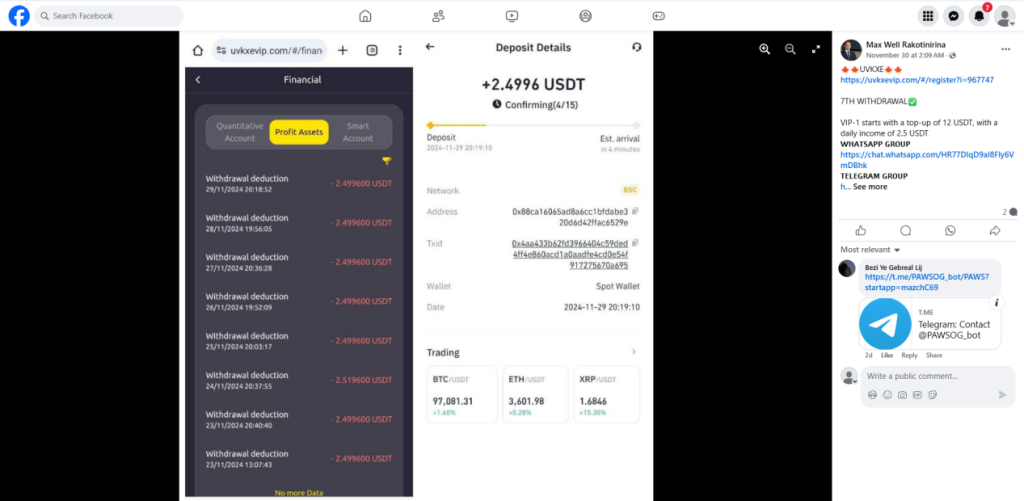

Recently, a 60-year-old male manager at a local private company fell victim to an investment scam while browsing social media. He was drawn to an advertisement promoting cryptocurrency investments. After clicking the ad, he was directed to an investment platform called UVKXEVIP. Following instructions from a WhatsApp group he joined, he accessed the platform via https://uvkxevip.com/, downloaded its app, and began investing.

Over the next few days, the manager transferred a total of RM300,000 to bank accounts provided by the scammers, hoping for high returns. However, when he attempted to withdraw his profits, he discovered that his funds were locked, making withdrawals impossible. It was only then that he realized he had been scammed and reported the incident to the police.

Warning: UVKXEVIP is a Fraudulent Platform

This serves as a public alert that https://uvkxevip.com/ is a scam website. Those unfamiliar with cryptocurrency investments are especially vulnerable. Scammers typically use fake investment advertisements and misleading links to lure victims into downloading counterfeit apps. Once engaged, they manipulate victims into transferring funds repeatedly to maximize their illicit gains.

How to Avoid Investment Scams

Do Not Trust Unsolicited Investment Opportunities

Avoid offers from social media platforms or recommendations by strangers.

Verify Platform Legitimacy

Always research and confirm the credibility of any investment platform, particularly those promising high returns.

Report Issues Promptly

If you experience difficulty withdrawing funds or notice unusual activity, report it to the authorities immediately.

Stay Alert

Be cautious and proactive to safeguard your finances from exploitation by fraudsters.